For 2025, the ira contribution limit. The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2025.

The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. You can make contributions to your roth ira after you reach age 70 ½.

For the tax year 2025, the maximum contribution to a roth ira is $7,000 for those younger than 50 and $8,000 for those who are 50 or older.

Roth Ira Conversion Calculator 2025 Mandi Rozella, Ira contribution limit increased for 2025. The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

2025 Roth Ira Limits Nissy Andriana, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. Is your income ok for a roth ira?

Roth Ira Contribution Limits 2025 For Married Susi Karalynn, You can make contributions to your roth ira after you reach age 70 ½. The irs's annual ira contribution limit covers contributions to all personal iras, including both traditional.

Everything You Need To Know About Roth IRAs, Roth iras have the same annual contribution limits as traditional iras. For 2025, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2025).

What Is The Roth Ira Limit For 2025 Claire Joann, Roth ira contribution limits for 2025. You can make contributions to your roth ira after you reach age 70 ½.

Roth Ira Limit 2025 Cal Iormina, You can make a full roth ira contribution for the 2025 tax year if you: The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Roth 401k 2025 Contribution Limit Irs Sybil Euphemia, In 2025, the roth ira contribution limit is. For 2025, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2025).

Max Roth 401 K Contribution 2025 Reena Catriona, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. You can contribute up to $7,000 to an ira in 2025, up from $6,500 in 2025.

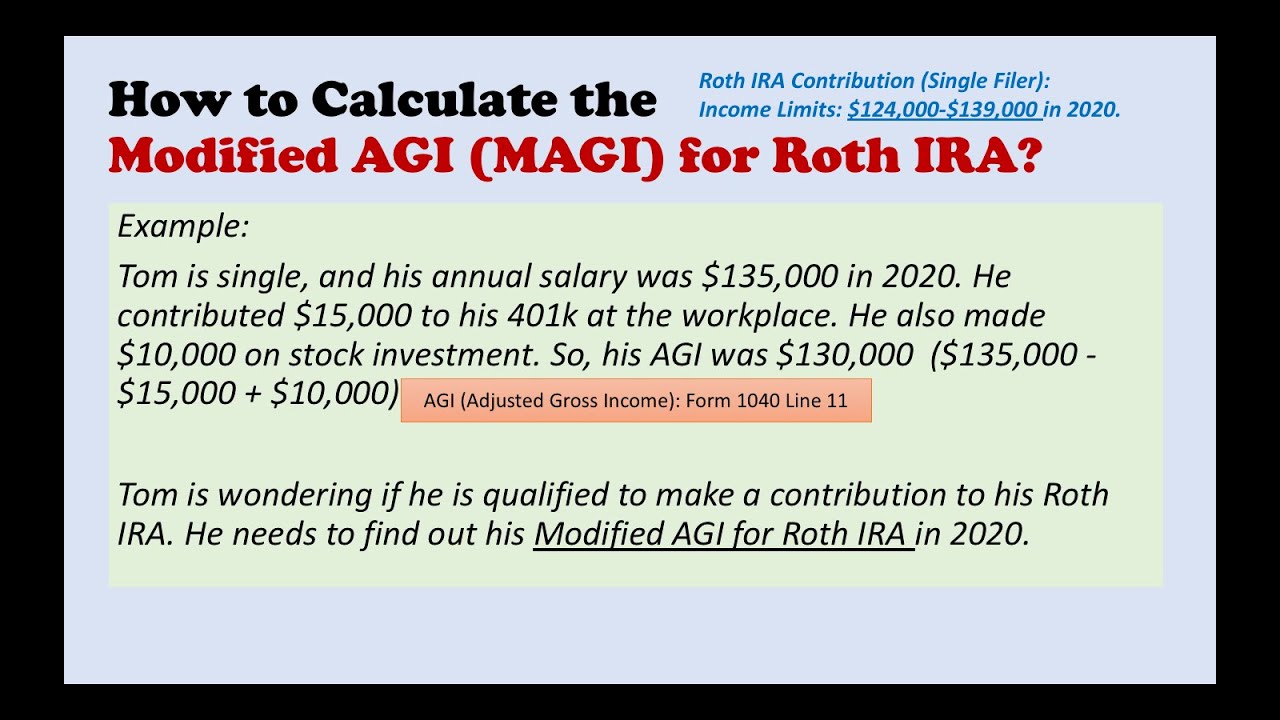

How to Calculate the Modified AGI (MAGI) for Roth IRA? YouTube, The roth ira contribution limits will increase in 2025. If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000.

Roth IRA Contribution Limit 2025 2025 Roth IRA Contribution Limits in, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. For 2025, the most that can be contributed to a child’s roth ira is $6,500 (people 50 or older can contribute $1,000 more).

This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.